Inflation, Pandemic and War? The Markets Have Priced That In.

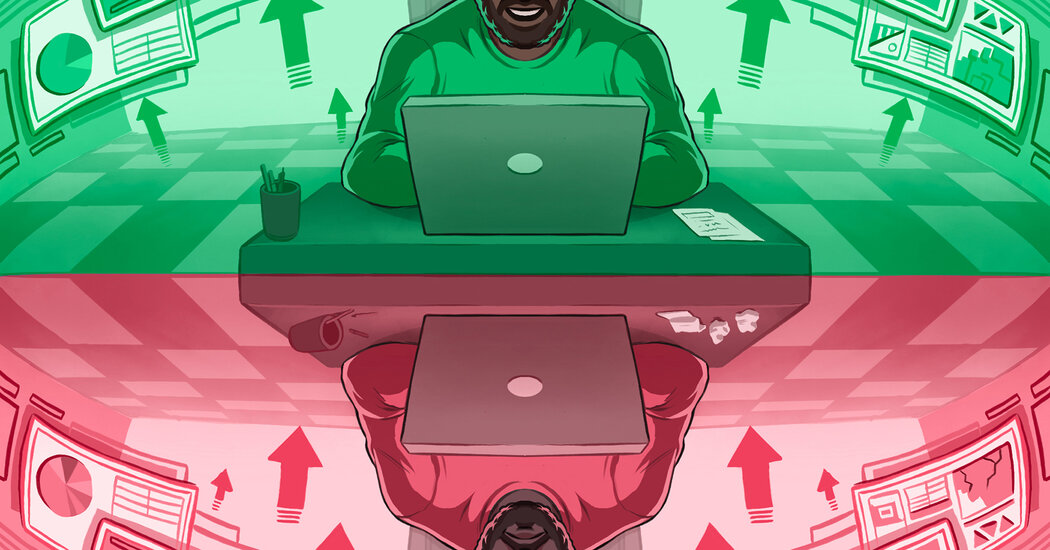

Rather than make fruitless forecasts, we can plan for a broad range of outcomes. But doing so requires dispassionate thinking — and the ability to see past the current news. Just as too much optimism can induce you to make foolish bets, excessive gloom can lead to panic — which, in this case, could mean fleeing investments in both stocks and bonds, because both major asset classes have performed poorly.

Instead, at cheerless times like these, it’s worth appreciating the potential for profit embedded in dreadfully low prices. First, always make sure you have enough ready cash to meet your emergency needs. But after that, if you invest steadily in diversified, low-cost index funds that track the entire stock and bond market, those low prices can be a boon, assuming the markets eventually recover. History suggests that they will.

Roaring inflation

It would be easy to give up on the markets.

Bad tidings about red-hot inflation have been hard to miss. Prices of a broad range of goods and services have been rising swiftly, but lately, the situation has gotten much worse. The most recent government report on the Consumer Price Index showed that overall inflation in the United States rose at an 8.5 percent annual rate in March, the highest pace since December 1981. A variety of other inflation measures have also been troubling, in the United States and around the world.

John Butters, senior research analyst for FactSet, a research company, wrote in a report on April 12 that 65 percent of S&P 500 companies that have reported earnings for the first quarter of this year cited inflation as their biggest problem. He cited this comment on an earnings call from Lawrence Kurzius, the chief executive of McCormick, the global food company: “Cost inflation has remained persistent with recent escalation in some areas such as transportation costs. And as such, we have raised our cost inflation guidance. It is now a mid- to high-teen increase.”

The three main causes of the current inflation burst are well-chronicled and include:

-

A combination of stimulative fiscal and monetary policy taken to support the economy’s recovery from the coronavirus recession of 2020.

-

Supply shortages caused by the pandemic, ranging from a scarcity of parts needed for automobiles to bottlenecks in factories in China, to an insufficient number of workers willing and able to take jobs at prevailing wages.

-

Russia’s war in Ukraine and the Western sanctions on Russia, which, together, have increased the prices of energy, food and a range of other commodities, and contributed to supply shortages.

Turning a corner

Yet the problem of raging inflation is hardly a new discovery. A year ago, it was evident that prices were rising rapidly enough that they needed to be taken seriously. I pointed that out then and so did many others.

Russia’s war complicates matters considerably. Nonetheless, it is at least possible that inflation is about to ebb. James Paulsen thinks so. He is chief investment strategist for the Leuthold Group, an independent stock research firm in Minneapolis.

The Russia-Ukraine War and the Global Economy

“I think we may be at a turning point,” he said in an interview. “There’s a good chance that inflation has peaked or is very near its peak.”

Check out our Latest News and Follow us at Facebook

Original Source