Carmakers at risk of using Uighur forced labour in China, HRW says | Automotive Industry

Taipei, Taiwan – Top carmakers, including General Motors, Toyota, Volkswagen, Tesla and BYD are at a high risk of using aluminium produced by forced labour in China’s Xinjiang province, a report by Human Rights Watch (HRW) has found.

China is the world’s largest car manufacturer as well as the largest producer of aluminium, which is used in tyres, windshield wipers, electric vehicle (EV) batteries and other automotive parts.

As much as one-fifth of China’s aluminium is produced by smelters in Xinjiang, where human rights groups believe more than one million ethnic minority Muslims have been subjected to internment and other abuses including forced labour and forced sterilisation.

HRW said in its report that carmakers are doing little to track their supply chains in China, and, in some cases, have succumbed to Chinese government pressure to apply weaker sourcing standards at their Chinese joint ventures than in their global operations.

“Most companies have done too little to map their supply chains for aluminium parts and identify and address potential links to Xinjiang,” the rights group said in its 99-page report released on Thursday.

“Confronted with an opaque aluminium industry and the threat of Chinese government reprisals for investigating links to Xinjiang, carmakers in many cases remain unaware of the extent of their exposure to forced labour. Consumers should as a result have little confidence that they are purchasing and driving vehicles free from links to abuses in Xinjiang.”

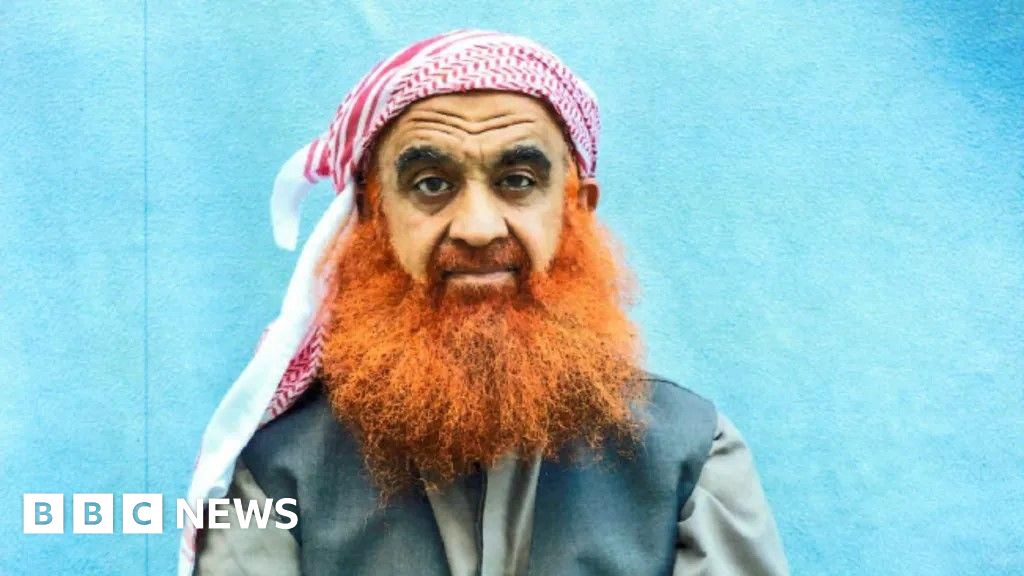

China has been accused of carrying out an aggressive programme of forced assimilation against Uighurs and other ethnic minority Muslims for more than a decade, leading to the internment of more than a million people in what Beijing has described as “vocational training centres”.

China has denied committing human rights violations in the region and insisted its programmes targeting ethnic minority Muslims have reduced radicalisation and terrorism.

In its report, HRW said “credible evidence”, including Chinese state media articles, company reports and government statements, indicates that aluminium producers in Xinjiang are participating in government-backed labour transfer programmes.

While countries including the United States have banned products made in Xinjiang, materials like aluminium can be difficult to trace, the New York-based rights group said.

Xinjiang aluminium often takes the form of ingots, which can be melted down with other materials to make aluminium alloy, easily concealing its provenance.

Michael Dunne, CEO of Dunne Insights and an expert on China’s automotive industry, said that mapping supply chains in China can be an extremely difficult task.

“Supply chains for automakers in China are somewhere on the spectrum between exceptionally byzantine and an iron-clad black box,” Dunne told Al Jazeera. “It’s like counting to infinity – you might make progress but you’ll never get there.”

HRW said car manufacturers should do more to map their supply chains or put pressure on their joint partners in China to do the same.

HRW said Volkswagen said in response to inquiries that the carmaker has “no transparency about the supplier relationships” with its joint-venture partners in China.

HRW said General Motors, Toyota and BYD did not respond to inquiries, but General Motors noted in its annual report the difficulty of tracing their Chinese supply chain.

Tesla, which does not operate with a joint venture, said it had “in several cases” mapped its supply chain back to the mining level and not found evidence of forced labour but did not specify further, according to HRW.

The five carmakers did not respond to Al Jazeera’s requests for comment.

Duncan Jepsen, a supply chain expert and UK-trained solicitor, said tracing supply chains is an issue of cost and will on the part of manufacturers.

“For an NGO, it may be difficult to track a supply chain in China. In other places in China, for a large, well-capitalised car manufacturer with no financial resources … I think the answer is it’s expensive, maybe. But it’s not that hard,” Jepsen told Al Jazeera.

“And that’s really the crux of the problem … It’s challenging and difficult and almost impossible if you want to spend nothing on it,” he added.

China’s huge market also gives it leverage over carmakers.

On top of being the world’s largest vehicle manufacturer, China is also the largest market for vehicle sales – with 23.5 million vehicles sold in 2022 compared with 13.6 million in the US, according to HRW.

“That’s the catch-22 they’ve got is that it’s not a country that they particularly want to leave,” Jepsen said.

“So if they want their market penetration, it’s going to be a big strategic decision of how auto manufacturers handle this. And it’s going to be interesting to watch.”

Check out our Latest News and Follow us at Facebook

Original Source