What Is a ‘Poison Pill’ Defense?

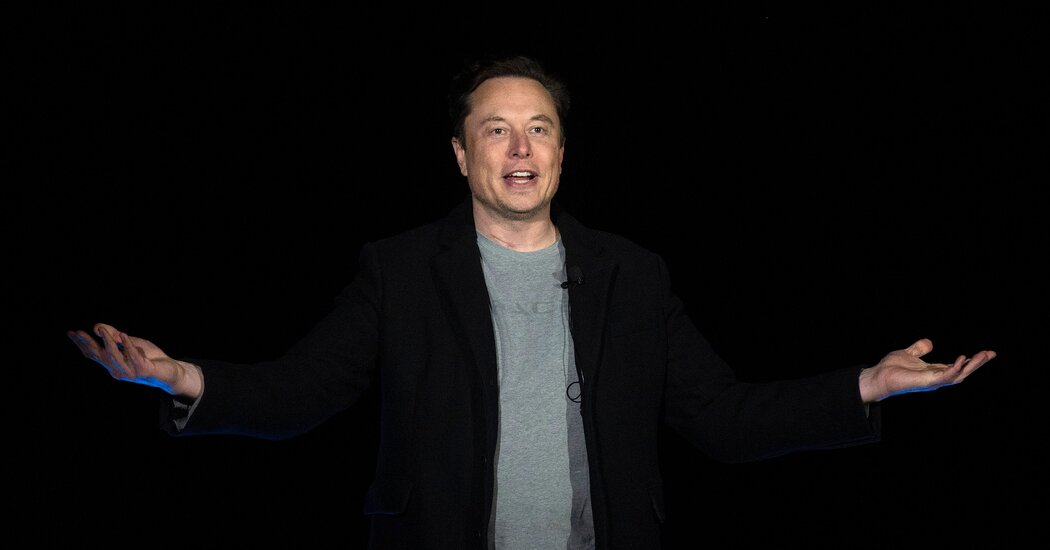

On Friday, Twitter countered Elon Musk’s offer to buy the company for more than $43 billion with a corporate tool known as a poison pill, a defensive strategy familiar to boardrooms trying to fend off takeovers but less familiar to everyday investors.

This defense mechanism was developed in the 1980s as company leaders, facing corporate raiders and hostile acquisitions, tried to defend their businesses from being acquired by another enterprise, person or group.

What is a poison pill?

A poison pill is a maneuver that typically makes a company less palatable to a potential acquirer by making it more expensive for the acquirer to buy shares of the target company above a certain threshold.

“The whole point of it is to make the offer from the board more attractive than the acquirer,” said Carliss Chatman, an associate professor of law at Washington and Lee University.

The strategy also gives a company more time to evaluate an offer and can give the board leverage in trying to force a direct negotiation with the potential acquirer.

Read More on Elon Musk and His Twitter Bid

The billionaire’s offer could be worth more than $40 billion and have far-reaching consequences on the social media company.

What does a poison pill actually look like?

A poison pill is officially known as a shareholder rights plan, and it can appear in a company’s charter or bylaws or exist as a contract among shareholders.

There are different types of poison pills, but usually, they allow certain shareholders to buy additional stock at a discounted price, said Ann Lipton, an associate professor of law at Tulane University.

The only shareholder blocked from making these discounted purchases is the one who triggers the poison pill. It is triggered when a person, usually the acquirer, hits a threshold for how many shares they own. If they hit that threshold, the value of their shares is suddenly diluted as other shareholders make discounted purchases.

Securities experts say that investors rarely try to break through a poison pill threshold, though there are exceptions.

The pizza chain Papa John’s adopted a poison pill in July 2018 in a rare instance of a company trying to block its founder from taking over. The founder, John Schnatter, exited after a report that he had used a racial slur in a conference call, a statement he subsequently said in court had been mischaracterized. He owned 30 percent of its stock at the time.

The poison pill would have allowed shareholders to buy stock at a discount if Mr. Schnatter, his family members or friends raised their stake in the company to 31 percent or if anyone else bought 15 percent of the stock without the board’s approval. The dispute ended with a settlement in March 2019.

In Twitter’s case, the pill would flood the market with new shares if Mr. Musk, or any other individual or group working together, bought 15 percent or more of Twitter’s shares. That would immediately dilute Mr. Musk’s stake and make it significantly more difficult to buy up a sizable portion of the company. Mr. Musk currently owns more than 9 percent of the company’s stock.

Are there limits to using a poison pill?

Ms. Lipton said a company could be limited by the ceiling in its charter on how many shares it is allowed to issue. But even if it has hit that ceiling, she said, a company has other options to make the purchase unattractive.

And poison pills could also be evaded if the acquirer or the shareholders sue the company for violating its fiduciary duties. But, Ms. Lipton said, courts have shown “incredible reluctance” to interfere.

“Boards have a terrific amount of leeway to judge what is in the best interest of shareholders, particularly if they are made up of independent directors,” she said. Boards often implement poison pills on a temporary basis so that they can consider their options with more time.

Are poison pills effective?

Very, according to Professor Chatman. She said that hostile takeovers are not as common as they were in the 1980s because potential acquirers now assume that companies have poison pill provisions in place.

When else have poison pills been used?

Netflix successfully fended off the billionaire investor Carl Icahn in November 2012, using a poison pill that would have made it more expensive for Mr. Icahn, or any other person or group, to accumulate more shares of Netflix if they acquired 10 percent of the company without the approval of its board.

Almost a year later, in October 2013, Men’s Wearhouse survived an acquisition attempt by Jos. A. Bank Clothiers after it adopted a poison pill. (Men’s Wearhouse then acquired Jos. A. Bank in March 2014, and the owner of both companies filed for bankruptcy in August 2020.)

In September 1985, in the wake of rumors that the consumer goods company Philip Morris was targeting it, the McDonald’s Corporation said it had adopted a poison pill plan to prevent “abusive takeover tactics.” (The company said the plan was not adopted in response to any known offer.) A few years later, the Walt Disney Company announced it had adopted one, calling it “a sound and reasonable means of safeguarding the interests of all stockholders.”

Check out our Latest News and Follow us at Facebook

Original Source